Effective risk management is crucial for the success and sustainability of any business. In today’s dynamic and competitive business environment, organizations face a wide range of risks that can impact their operations, finances, and reputation. From market volatility and regulatory changes to cybersecurity threats and natural disasters, businesses must proactively identify, assess, and mitigate potential risks to protect their interests and ensure long-term growth.

In this blog post, we will explore the importance of effective risk management in business and discuss key strategies for identifying and assessing risks. We will also delve into the implementation of risk management plans to mitigate potential threats and the role of technology in enhancing risk management processes. Additionally, we will highlight best practices for monitoring and reviewing risk management strategies to ensure ongoing effectiveness and adaptability in the face of evolving risks.

Stay tuned as we delve into the critical aspects of risk management and provide valuable insights to help businesses navigate and mitigate potential risks effectively.

The Importance of Effective Risk Management in Business

Minimizing Financial Losses

Effective risk management in business is crucial for minimizing financial losses. By identifying potential risks and implementing strategies to mitigate them, companies can avoid costly setbacks. This includes assessing market risks, operational risks, and financial risks to ensure the long-term financial stability of the business.

Enhancing Decision-Making

Proper risk management also enhances decision-making within the organization. When potential risks are identified and analyzed, it allows for more informed and strategic decision-making. This can lead to better resource allocation, improved project planning, and ultimately, more successful outcomes for the business.

Building Trust and Reputation

Effective risk management can also help build trust and reputation for the business. By demonstrating a commitment to identifying and addressing potential risks, companies can instill confidence in stakeholders, including customers, investors, and partners. This can lead to stronger relationships and a positive reputation in the industry.

Key Strategies for Identifying and Assessing Risks in Risk Management

Understanding the Nature of Risks

One of the key strategies for identifying and assessing risks in risk management is to have a clear understanding of the nature of risks. This involves recognizing the different types of risks that an organization may face, such as financial, operational, strategic, and compliance risks. By understanding the nature of these risks, organizations can better assess their potential impact and likelihood of occurrence.

Utilizing Risk Assessment Tools and Techniques

Another important strategy is to utilize risk assessment tools and techniques to identify and assess risks. This may involve using quantitative and qualitative methods to evaluate the potential impact and likelihood of risks. For example, organizations may use risk matrices, scenario analysis, or Monte Carlo simulations to assess risks and their potential impact on the organization.

Implementing Risk Management Frameworks

Implementing risk management frameworks is also crucial for identifying and assessing risks. This involves establishing a structured approach to managing risks, including defining risk appetite, establishing risk tolerance levels, and developing risk mitigation strategies. By implementing a risk management framework, organizations can systematically identify, assess, and respond to risks in a consistent and effective manner.

Implementing Risk Management Plans to Mitigate Potential Threats

The Importance of Risk Management

Risk management is a crucial aspect of any business or organization. It involves identifying, assessing, and prioritizing potential risks and developing strategies to mitigate or eliminate them. By implementing effective risk management plans, businesses can protect their assets, reputation, and financial stability.

Key Components of a Risk Management Plan

When creating a risk management plan, it’s essential to consider several key components. These include:

- Identification of potential risks

- Assessment of the likelihood and impact of each risk

- Development of strategies to mitigate or eliminate risks

- Regular monitoring and review of the plan

Implementing Risk Management in Practice

Implementing a risk management plan involves a systematic approach to identifying, assessing, and addressing potential threats. This may include:

- Conducting a thorough risk assessment to identify potential threats

- Developing strategies to mitigate or eliminate identified risks

- Implementing risk control measures and monitoring their effectiveness

- Regularly reviewing and updating the risk management plan as needed

The Role of Technology in Enhancing Risk Management Processes

Automation of Risk Assessment

One of the key ways technology enhances risk management processes is through the automation of risk assessment. With the use of advanced algorithms and data analytics, technology can quickly and accurately assess potential risks within an organization. This not only saves time but also ensures a more comprehensive and consistent approach to risk assessment.

Real-time Monitoring and Reporting

Technology allows for real-time monitoring of various risk factors, such as market fluctuations, cybersecurity threats, and operational vulnerabilities. This enables organizations to stay ahead of potential risks and take proactive measures to mitigate them. Additionally, technology facilitates the generation of detailed reports, providing valuable insights for decision-making and compliance purposes.

Integration of Risk Management Systems

Another significant role of technology in risk management is the integration of various risk management systems. This includes the integration of enterprise risk management (ERM) software, compliance management tools, and internal control systems. By streamlining these processes through technology, organizations can achieve a more holistic and efficient approach to risk management.

Table: Comparison of Manual vs. Automated Risk Assessment

| Manual Risk Assessment | Automated Risk Assessment |

| Time-consuming and prone to human error | Efficient and accurate |

| Limited scope and scalability | Comprehensive and scalable |

| Dependent on individual expertise | Utilizes advanced algorithms and data analytics |

Features of Technology-Enabled Risk Management:

- Advanced data analytics

- Real-time monitoring

- Integration of ERM systems

- Customizable reporting

- Automated alerts and notifications

Procedures for Implementing Technology in Risk Management:

- Assessing organizational needs and risk factors

- Researching and selecting appropriate technology solutions

- Training staff on new systems and processes

- Regular monitoring and updates to technology infrastructure

Best Practices for Monitoring and Reviewing Risk Management Strategies

Regular Assessment of Risk Management Framework

One of the best practices for monitoring and reviewing risk management strategies is to conduct regular assessments of the risk management framework. This involves evaluating the effectiveness of the existing risk management processes, identifying any gaps or weaknesses, and implementing necessary improvements. By regularly assessing the risk management framework, organizations can ensure that they are adequately prepared to identify, assess, and mitigate potential risks.

Utilization of Key Performance Indicators (KPIs)

Another important practice for monitoring and reviewing risk management strategies is the utilization of key performance indicators (KPIs). KPIs provide valuable insights into the performance of risk management processes and help in identifying areas that require attention. By tracking KPIs such as risk exposure, risk mitigation effectiveness, and risk response time, organizations can gain a better understanding of their risk management performance and make informed decisions to enhance their strategies.

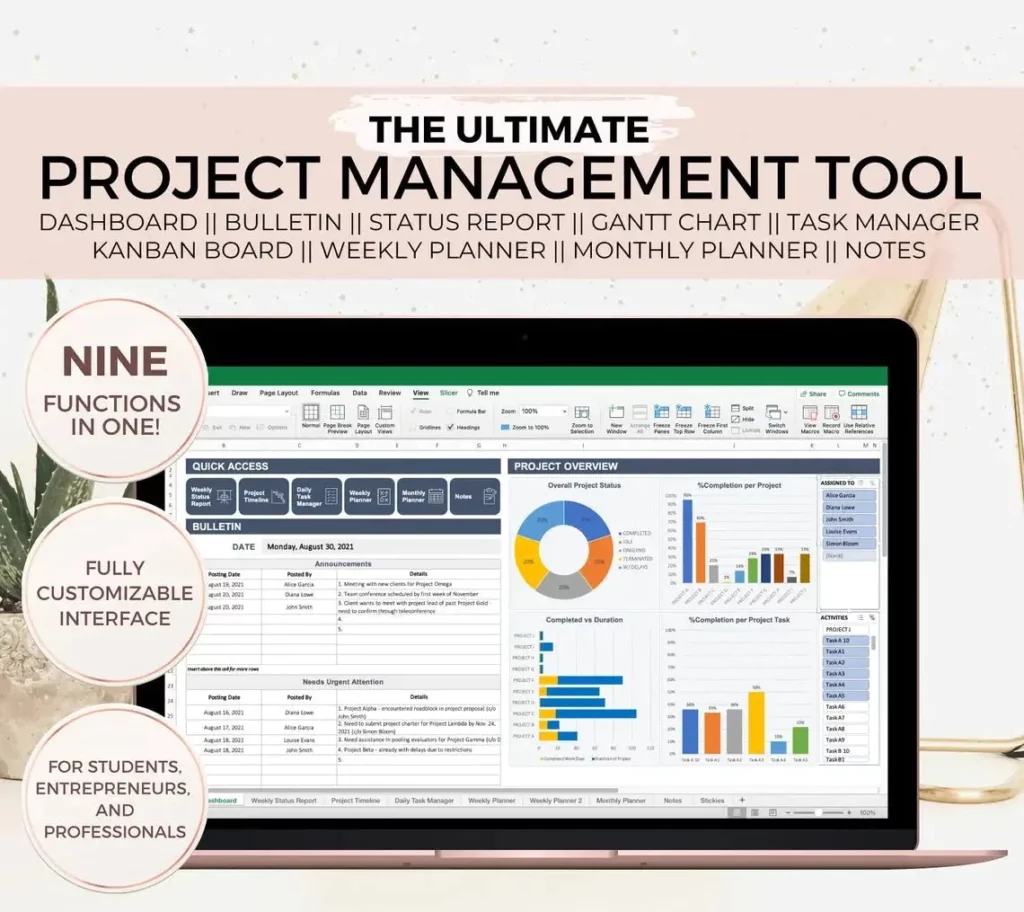

Implementation of Risk Management Software

Implementing risk management software can significantly improve the monitoring and reviewing of risk management strategies. This software can provide real-time data on risk exposure, automate risk assessment processes, and facilitate the tracking of risk management KPIs. Additionally, it can streamline communication and collaboration among stakeholders involved in risk management, leading to more efficient and effective strategies.

Conclusion

Effective risk management is crucial for the success and sustainability of any business. By identifying and assessing potential risks, implementing comprehensive risk management plans, and leveraging technology to enhance processes, organizations can proactively mitigate threats and capitalize on opportunities.

It is essential for businesses to adopt best practices for monitoring and reviewing risk management strategies to ensure ongoing effectiveness and adaptability in the face of evolving challenges.

As technology continues to advance, the landscape of risk management is constantly evolving. It is imperative for businesses to stay informed about the latest developments and trends in risk management to stay ahead of the curve.

By prioritizing risk management, businesses can not only protect themselves from potential harm but also position themselves for long-term success and growth. Embracing a proactive approach to risk management can ultimately lead to a competitive advantage in the marketplace.

As you continue to navigate the complexities of risk management in your business, remember that staying informed, proactive, and adaptable is key to effectively managing risks and maximizing opportunities.

Stay tuned for more insights and best practices on risk management to help you navigate the ever-changing business landscape with confidence and resilience.