Are you struggling to keep track of your finances and stay on top of your budget? With so many personal budget software options available, it can be overwhelming to find the best one for your financial needs. In this blog post, we will explore the top personal budget software options, compare their features and benefits, and provide tips on how to choose the best one for your lifestyle. We will also discuss the importance of personal budget software in achieving your financial goals and share tips for getting the most out of your personal budget software experience. Whether you’re a budgeting beginner or a seasoned pro, finding the right personal budget software can make a world of difference in managing your finances effectively. So, let’s dive in and find the best personal budget software for you.

Finding the Right Personal Budget Software for Your Financial Needs

Understanding Your Financial Goals

Before choosing a personal budget software, it’s important to understand your financial goals. Are you looking to save for a specific goal, track your spending, or create a comprehensive budget for all your expenses? Understanding your financial goals will help you narrow down the features you need in a personal budget software.

Key Features to Look For

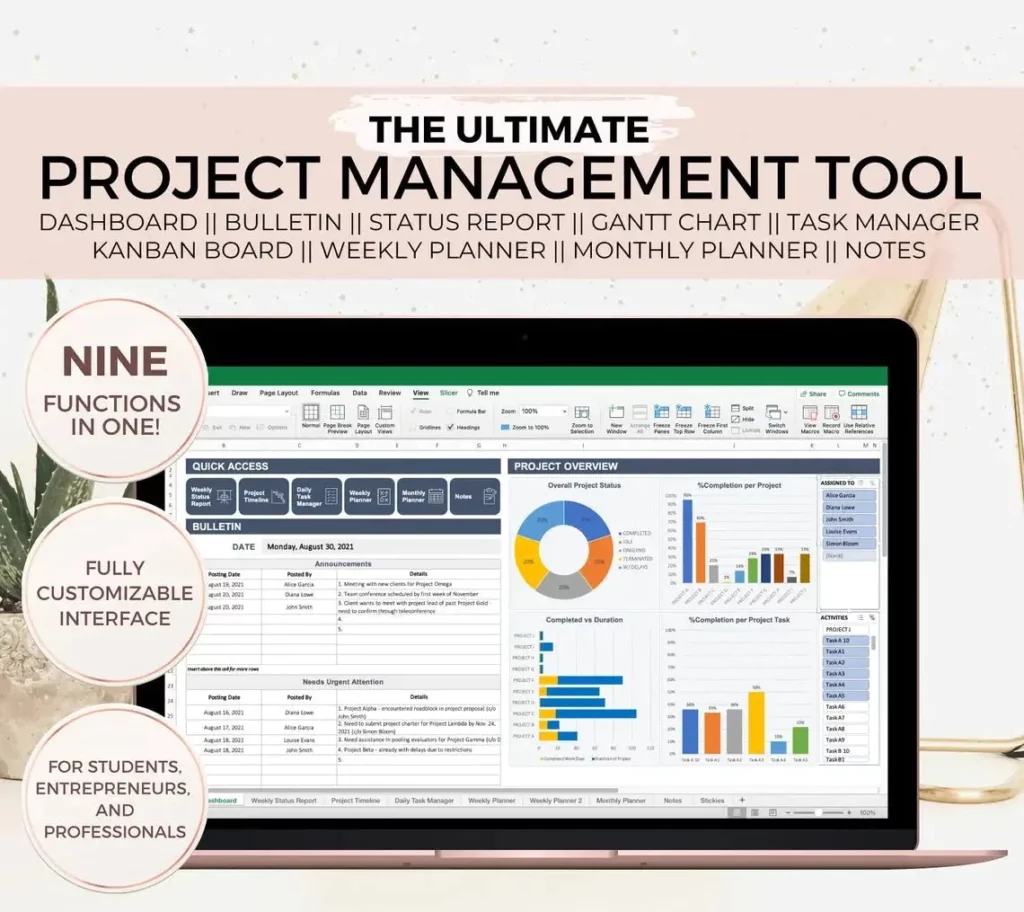

When searching for the right personal budget software, there are several key features to consider. Look for software that offers customizable budget categories, automatic transaction syncing, and goal tracking tools. Additionally, consider whether the software offers mobile access and reporting capabilities to help you stay on top of your finances.

Comparing Top Personal Budget Software Options

| Software | Key Features | Mobile Access | Price |

| 1. Mint | Customizable budget categories, automatic transaction syncing, goal tracking tools | Yes | Free |

| 2. You Need a Budget (YNAB) | Rule-based budgeting, goal tracking, reporting capabilities | Yes | $11.99/month |

| 3. Personal Capital | Investment tracking, retirement planner, net worth tracker | Yes | Free |

When comparing personal budget software options, consider the key features, mobile access, and pricing to find the best fit for your financial needs.

Comparing Top Personal Budget Software Options: Features and Benefits

Features of Personal Budget Software

When comparing top personal budget software options, it’s important to consider the features that each one offers. Look for software that includes features such as:

- Expense Tracking: The ability to track and categorize expenses, including recurring bills and one-time purchases.

- Budgeting Tools: Tools to help you create and stick to a budget, including setting spending limits and goals.

- Bill Payment Reminders: Reminders for upcoming bill payments to avoid late fees.

- Financial Goal Setting: Tools to set and track financial goals, such as saving for a vacation or paying off debt.

Benefits of Personal Budget Software

Using personal budget software can offer a range of benefits for individuals and families looking to improve their financial management. Some of the key benefits include:

- Improved Financial Awareness: By tracking expenses and income, users gain a better understanding of their financial situation.

- Time Savings: Automating bill payments and expense tracking can save time and reduce the risk of missing payments.

- Goal Achievement: Setting and tracking financial goals becomes easier with the help of budgeting software.

- Reduced Stress: Having a clear picture of your finances and a plan in place can reduce financial stress and anxiety.

Comparison of Top Personal Budget Software Options

Here’s a comparison of some of the top personal budget software options available, including their key features and benefits:

| Software | Key Features | Benefits |

| Software A | Expense tracking, budgeting tools, bill payment reminders | Improved financial awareness, time savings, goal achievement |

| Software B | Expense tracking, financial goal setting, budgeting tools | Reduced stress, improved financial awareness, time savings |

| Software C | Budgeting tools, bill payment reminders, expense tracking | Goal achievement, reduced stress, improved financial awareness |

How to Choose the Best Personal Budget Software for Your Lifestyle

Understanding Your Needs

Before choosing a personal budget software, it’s important to understand your specific needs. Are you looking for a simple tool to track your expenses, or do you need a more comprehensive solution that can handle investments and retirement planning? Take some time to assess your financial goals and the features that are most important to you.

Researching Available Options

Once you have a clear understanding of your needs, it’s time to research the available options. Look for software that offers the features you need, such as expense tracking, budgeting tools, and investment management. Consider reading reviews and comparing different products to find the one that best fits your lifestyle.

Comparing Features and Pricing

When comparing personal budget software, it’s important to consider both the features and pricing. Some software may offer advanced features that you don’t need, while others may lack essential tools. Additionally, consider the pricing structure – some software may offer a one-time purchase, while others may require a monthly subscription. Create a list of features and pricing for each option to help you make an informed decision.

The Importance of Personal Budget Software in Achieving Financial Goals

Tracking Expenses and Income

Personal budget software plays a crucial role in helping individuals track their expenses and income. By inputting all financial transactions into the software, users can gain a clear understanding of where their money is going and how much is coming in. This insight is essential for creating a realistic budget and identifying areas where spending can be reduced or increased.

Setting and Monitoring Financial Goals

Another key benefit of personal budget software is its ability to help users set and monitor financial goals. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, the software can track progress and provide visual representations of how close users are to reaching their goals. This feature can be incredibly motivating and help individuals stay on track with their financial plans.

Improving Financial Literacy

Using personal budget software can also contribute to improving financial literacy. Many software programs offer educational resources and tools to help users better understand concepts such as budgeting, saving, investing, and managing debt. By engaging with these resources, individuals can become more knowledgeable and confident in making sound financial decisions.

Tips for Getting the Most Out of Your Personal Budget Software Experience

Set Clear Financial Goals

Before diving into your personal budget software, take some time to set clear financial goals for yourself. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having specific goals in mind will help you stay motivated and focused when using the software.

Track Your Spending Regularly

One of the key benefits of personal budget software is its ability to track your spending automatically. Make sure to regularly review your transactions and categorize them accurately. This will give you a clear picture of where your money is going and help you identify areas where you can cut back or reallocate funds.

Utilize the Reporting Features

Most personal budget software comes with robust reporting features that can provide valuable insights into your financial habits. Take advantage of these reports to analyze your spending patterns, identify trends, and make informed decisions about your budget. Whether it’s a breakdown of your expenses by category or a comparison of your income versus your spending, these reports can be powerful tools for managing your finances.

Conclusion

Choosing the best personal budget software for your financial needs is a crucial step towards achieving your financial goals. By comparing the top personal budget software options and understanding their features and benefits, you can make an informed decision that aligns with your lifestyle and budgeting preferences.

It’s important to recognize the significance of personal budget software in helping you track your expenses, manage your income, and ultimately work towards financial stability. With the right software, you can gain valuable insights into your spending habits and make necessary adjustments to stay on track with your financial goals.

As you embark on your personal budget software journey, remember to make the most out of the experience by utilizing the tips and best practices shared in this blog post. Whether it’s setting realistic budgeting goals, regularly reviewing your financial progress, or taking advantage of the software’s features, these actions can help you maximize the benefits of your chosen personal budget software.

Ultimately, the best personal budget software is one that empowers you to take control of your finances and work towards a secure financial future. We hope this guide has provided you with valuable insights to make an informed decision and take the next step towards achieving your financial aspirations.

Take the time to explore the various personal budget software options available, and choose the one that best suits your needs. With the right software by your side, you can pave the way for a more organized and financially secure future.

Remember, your financial well-being is worth the investment in the best personal budget software for you.