Are you looking for the best free software for financial planning? In today’s digital age, there are numerous options available to help you manage your finances effectively without breaking the bank. In this blog post, we will explore the top free financial planning tools, understand their features, and compare the best options to help you make an informed decision. Whether you’re a budget-conscious individual or a small business owner, finding the right free software for financial planning is essential for achieving your financial goals. Join us as we delve into the world of free financial planning software and discover the tips for choosing the best one for your needs.

Finding the Right Free Software for Financial Planning

Understanding Your Financial Needs

Before diving into the world of free financial planning software, it’s important to understand your specific financial needs. Are you looking for a tool to help with budgeting, investment tracking, or retirement planning? Identifying your priorities will help you narrow down the options and find the software that best suits your requirements.

Researching Available Options

Once you have a clear understanding of your financial needs, it’s time to research the available free software options. Look for user reviews, expert opinions, and feature comparisons to get a comprehensive understanding of what each tool has to offer. Pay attention to factors such as user interface, security features, and customer support to ensure a positive experience with the software.

Comparing Features and Functionality

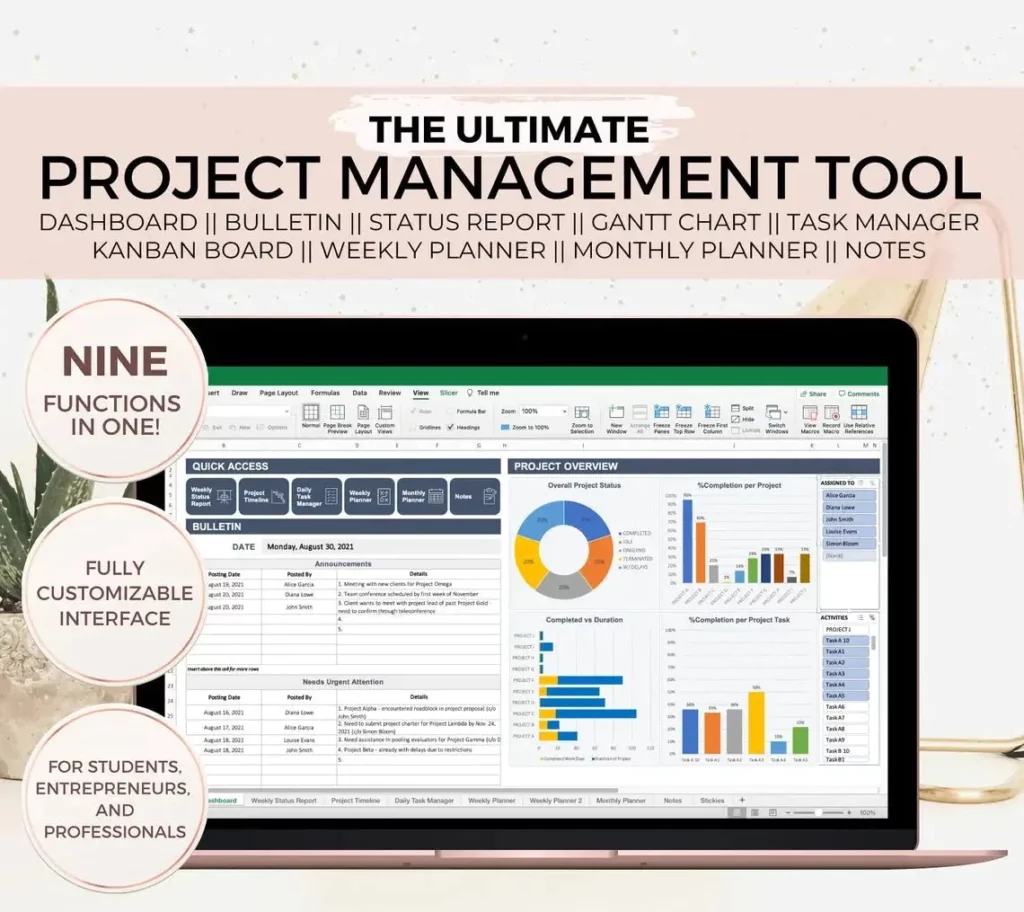

After researching the available options, it’s essential to compare the features and functionality of each software. Create a list of must-have features and prioritize them based on your needs. Look for tools that offer comprehensive financial tracking, goal setting, and reporting capabilities. Consider creating a table to compare the features side by side, making it easier to identify the software that aligns with your financial goals.

Exploring the Top Free Financial Planning Tools

Mint

Mint is a popular free financial planning tool that allows users to track their spending, create budgets, and set financial goals. With Mint, users can link their bank accounts, credit cards, and other financial accounts to get a comprehensive view of their finances. The tool also provides personalized recommendations for saving money and reducing fees. Additionally, Mint offers a free credit score and monitoring service to help users stay on top of their credit health.

Personal Capital

Personal Capital is another free financial planning tool that offers a range of features to help users manage their money. In addition to budgeting and expense tracking, Personal Capital provides investment tracking and retirement planning tools. Users can link their investment accounts to get a holistic view of their financial portfolio and access personalized investment advice. The tool also offers a retirement planner to help users set and track their retirement goals.

NerdWallet

NerdWallet is a comprehensive financial planning tool that offers a wide range of resources and calculators to help users make informed financial decisions. The tool provides personalized recommendations for credit cards, loans, insurance, and investment accounts based on the user’s financial profile. NerdWallet also offers educational content on various financial topics, such as saving for retirement, buying a home, and managing debt. Users can access free calculators to estimate their mortgage payments, retirement savings needs, and more.

Understanding the Features of Free Financial Planning Software

Comprehensive Financial Tracking

Free financial planning software offers comprehensive financial tracking, allowing users to monitor their income, expenses, investments, and savings in one place. This feature provides a holistic view of an individual’s financial health, making it easier to identify areas for improvement and set realistic financial goals.

Budgeting Tools

Many free financial planning software options come with budgeting tools that help users create and manage a budget. These tools often include customizable categories for expenses, as well as the ability to set spending limits and track progress. By utilizing these budgeting tools, individuals can gain better control over their finances and make more informed spending decisions.

Investment Analysis

Free financial planning software often includes investment analysis features that allow users to track the performance of their investments and analyze their portfolio’s diversification. This can help individuals make more informed investment decisions and optimize their investment strategy for long-term financial growth.

| Feature | Benefits |

| Comprehensive Financial Tracking | Provides a holistic view of financial health |

| Budgeting Tools | Helps create and manage a budget |

| Investment Analysis | Allows tracking and analyzing investment performance |

Overall, free financial planning software offers a range of features that can help individuals take control of their finances and work towards their financial goals. By leveraging these tools, users can gain a better understanding of their financial situation and make more informed decisions for their future.

Comparing the Best Free Financial Planning Software Options

Insights on the Topic

When it comes to managing your finances, having the right tools can make all the difference. Free financial planning software can help you track your expenses, create budgets, and plan for the future without breaking the bank. In this blog, we’ll compare some of the best free options available to help you make an informed decision.

Top Free Financial Planning Software

1. Mint: Mint is a popular free financial planning software that allows you to track your spending, create budgets, and set financial goals. It also offers credit score monitoring and personalized financial insights.

2. Personal Capital: Personal Capital is another free option that offers tools for budgeting, investment tracking, and retirement planning. It also provides a comprehensive view of your financial accounts and net worth.

Features to Consider

- Expense tracking

- Budget creation and monitoring

- Investment tracking

- Retirement planning tools

- Credit score monitoring

- Net worth calculation

| Software | Expense Tracking | Budgeting | Investment Tracking | Retirement Planning |

| Mint | Yes | Yes | No | No |

| Personal Capital | Yes | Yes | Yes | Yes |

Tips for Choosing the Best Free Software for Financial Planning

Understanding Your Needs

Before diving into the world of free financial planning software, it’s important to understand your specific needs. Are you looking for a tool to help with budgeting, investment tracking, or retirement planning? Knowing what you need will help narrow down your options and find the best fit for your financial goals.

Researching Available Options

Once you have a clear understanding of your needs, it’s time to research the available options. Look for software that offers the features you require, such as budget tracking, goal setting, and investment analysis. Consider reading reviews and comparing user ratings to get a sense of the overall user experience.

Testing and Evaluating

After narrowing down your options, it’s important to test and evaluate the software before committing to one. Look for free trials or demo versions to get a feel for the user interface and functionality. Pay attention to how intuitive the software is to use and whether it meets your specific needs. Additionally, consider factors such as customer support and security features when making your final decision.

Conclusion

When it comes to finding the best free software for financial planning, it’s essential to consider your specific needs and goals. By exploring the top free financial planning tools and understanding their features, you can make an informed decision that aligns with your financial objectives.

Comparing the best free financial planning software options allows you to weigh the pros and cons of each, ensuring that you select the right fit for your personal or business finances. Remember to keep in mind the tips for choosing the best free software for financial planning, such as considering user-friendliness, security features, and customer support.

Ultimately, the best free software for financial planning is the one that empowers you to take control of your financial future. Whether you’re looking to create a budget, track expenses, or plan for retirement, there are numerous free tools available to help you achieve your financial goals.

Take the time to explore the options mentioned in this blog post and consider giving them a try. With the right free financial planning software, you can gain clarity and confidence in managing your finances, paving the way for a more secure and prosperous future.

Remember, the best free software for financial planning is the one that works best for you. Happy planning!