Are you interested in pursuing a career in risk management and insurance? The dynamic and ever-evolving field offers a wide range of opportunities for individuals with the right skills and qualifications. In this blog post, we will explore the exciting world of careers in risk management and insurance, discussing the essential skills and qualifications for success, various career paths and opportunities, the impact of technology and innovation, as well as the challenges and rewards of navigating this field. Whether you are a seasoned professional or a newcomer to the industry, this post will provide valuable insights into the diverse and rewarding world of risk management and insurance careers.

Exploring the Exciting World of Careers in Risk Management & Insurance

The Growing Demand for Risk Management & Insurance Professionals

As businesses and organizations continue to face a wide range of risks, the demand for skilled professionals in risk management and insurance is on the rise. According to the Bureau of Labor Statistics, the employment of insurance underwriters, appraisers, examiners, and investigators is projected to grow 3 percent from 2020 to 2030, adding about 16,900 new jobs. This growth is driven by the need to assess and manage risks in various industries, including finance, healthcare, and technology.

Key Skills and Qualifications for Success

Professionals in the field of risk management and insurance need a combination of technical expertise and soft skills to excel in their careers. Some of the key skills and qualifications include a strong understanding of financial analysis, risk assessment, and insurance principles. Additionally, effective communication, critical thinking, and problem-solving skills are essential for professionals to analyze and mitigate risks effectively. Pursuing relevant certifications, such as the Chartered Property Casualty Underwriter (CPCU) designation, can also enhance career prospects in this field.

Opportunities for Growth and Advancement

Careers in risk management and insurance offer diverse opportunities for growth and advancement. Professionals can specialize in various areas, such as underwriting, claims adjusting, risk consulting, and actuarial analysis. With experience and expertise, individuals can progress to leadership roles, such as risk managers, insurance directors, and chief risk officers. Furthermore, the evolving landscape of risk, including cybersecurity threats and climate change, presents new challenges and opportunities for professionals to make a meaningful impact in their careers.

The Essential Skills and Qualifications for Success in Risk Management & Insurance Careers

Analytical Skills

One of the most important skills for success in risk management and insurance careers is strong analytical skills. Professionals in this field need to be able to analyze complex data, assess risks, and make informed decisions based on their findings. Attention to detail and the ability to think critically are essential for success in this area.

Communication Skills

Effective communication is crucial in risk management and insurance careers. Professionals need to be able to clearly articulate complex concepts to clients, colleagues, and other stakeholders. Additionally, strong negotiation skills are important for securing favorable terms for clients.

Qualifications and Certifications

While many entry-level positions in risk management and insurance may only require a bachelor’s degree, obtaining professional certifications can significantly enhance career prospects. Certifications such as the Chartered Property Casualty Underwriter (CPCU) or the Associate in Risk Management (ARM) demonstrate a commitment to professional development and can open doors to advanced positions and higher salaries.

Career Paths and Opportunities in the Dynamic Field of Risk Management & Insurance

Risk Management and Insurance: An Overview

Risk management and insurance are crucial components of any organization’s operations. Professionals in this field are responsible for identifying, assessing, and mitigating potential risks that could impact the financial stability and reputation of a company. They also play a key role in developing and implementing insurance strategies to protect against these risks.

Career Paths in Risk Management and Insurance

Individuals interested in pursuing a career in risk management and insurance have a wide range of opportunities to explore. Some common career paths in this field include:

- Risk Analyst

- Insurance Underwriter

- Claims Adjuster

- Risk Manager

- Insurance Broker

- Actuary

Opportunities for Growth and Advancement

Professionals in risk management and insurance have the potential for significant growth and advancement in their careers. With the increasing complexity of risks faced by organizations, there is a growing demand for skilled individuals who can effectively manage and mitigate these risks. Additionally, the evolving regulatory landscape and advancements in technology are creating new opportunities for professionals in this field to expand their expertise and take on leadership roles.

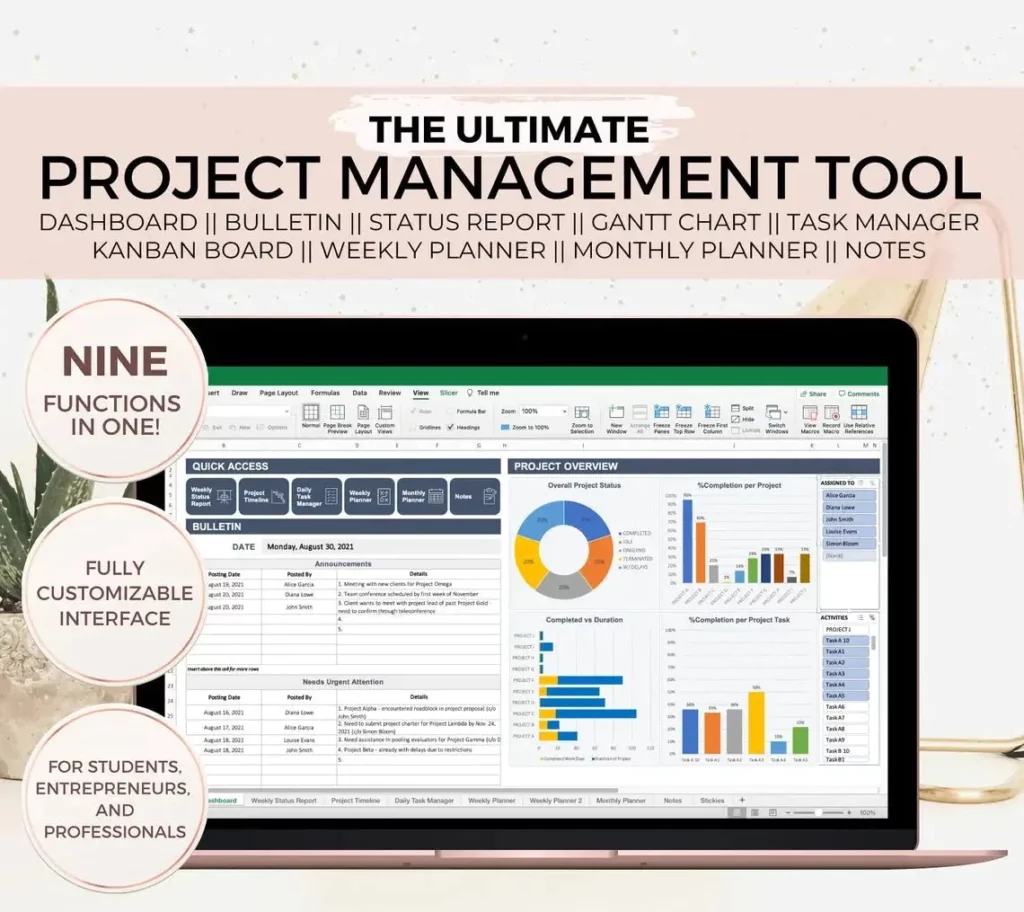

The Impact of Technology and Innovation on Careers in Risk Management & Insurance

Automation and Artificial Intelligence in Risk Management

Technology and innovation have significantly impacted the field of risk management and insurance. One of the most notable changes is the integration of automation and artificial intelligence (AI) into risk assessment and underwriting processes. With the help of advanced algorithms and machine learning, insurance companies can now analyze vast amounts of data to assess risks and predict potential losses more accurately and efficiently. This has not only streamlined the underwriting process but also improved the overall accuracy of risk assessment, leading to better pricing and coverage decisions.

Digital Transformation in Insurance Sales and Customer Service

Another area where technology has made a significant impact is in insurance sales and customer service. Digital transformation has revolutionized the way insurance products are marketed, sold, and serviced. With the rise of online platforms and mobile apps, insurance agents and brokers can now reach a wider audience and provide personalized services to their clients. Additionally, the use of chatbots and virtual assistants has improved customer service by providing instant support and guidance to policyholders, enhancing their overall experience with the insurance company.

Cybersecurity and Risk Mitigation

As technology continues to advance, the risk landscape for businesses and individuals has also evolved. Cybersecurity has become a critical concern for both risk management professionals and insurance companies. The increasing frequency and sophistication of cyber-attacks have led to a growing demand for specialized insurance products and risk mitigation strategies to protect against data breaches and other cyber threats. This has created new opportunities for risk management professionals to specialize in cybersecurity and for insurance companies to develop innovative coverage solutions to address this emerging risk.

Navigating the Challenges and Rewards of a Career in Risk Management & Insurance

The Importance of Risk Management & Insurance

Risk management and insurance play a crucial role in today’s business landscape. Companies and individuals alike rely on risk management professionals to identify, assess, and mitigate potential risks, as well as to provide financial protection through insurance policies. This field offers a dynamic and challenging career path for those with a keen eye for detail and a passion for problem-solving.

Challenges in Risk Management & Insurance

One of the main challenges in this field is the ever-evolving nature of risks. Risk management professionals must stay abreast of industry trends, regulatory changes, and emerging risks to effectively protect their clients. Additionally, navigating the complexities of insurance policies and claims processes can be daunting. However, those who thrive in this environment find it intellectually stimulating and rewarding.

Rewards of a Career in Risk Management & Insurance

Despite the challenges, a career in risk management and insurance offers numerous rewards. Professionals in this field have the opportunity to make a tangible impact by safeguarding businesses and individuals from potential financial losses. Moreover, the demand for skilled risk management professionals continues to grow, providing ample opportunities for career advancement and financial stability.

Conclusion

As we conclude our exploration of careers in risk management & insurance, it’s clear that this dynamic field offers a wealth of opportunities for individuals with the right skills and qualifications. Whether you’re drawn to the analytical side of risk assessment, the strategic aspects of risk mitigation, or the innovative potential of technology in this industry, there’s a path that aligns with your interests and strengths.

From the essential skills and qualifications needed for success to the various career paths available, it’s evident that risk management & insurance is a field that rewards dedication, expertise, and adaptability. The impact of technology and innovation continues to shape the industry, presenting new challenges and opportunities for professionals to make their mark.

As you navigate the challenges and rewards of a career in risk management & insurance, remember that continuous learning and professional development are key to staying ahead in this ever-evolving landscape. Embrace the changes, seek out mentorship and networking opportunities, and stay informed about the latest trends and best practices.

Whether you’re just starting your journey in this field or looking to advance your existing career, the world of risk management & insurance is filled with potential for growth and fulfillment. Take the time to explore the various paths available, and don’t hesitate to pursue opportunities that align with your passions and ambitions.

Ultimately, a career in risk management & insurance offers the chance to make a meaningful impact, contribute to the success of businesses and individuals, and continuously challenge yourself to excel. Embrace the excitement and possibilities that this field has to offer, and embark on a rewarding professional journey that aligns with your aspirations.

Are you ready to take the next step in your career in risk management & insurance? Explore the possibilities, invest in your professional development, and seize the opportunities that await you in this dynamic and essential industry.